What is the real estate acquisition tax?

The following text has been extracted mainly from materials published by the Tokyo Metropolitan Government and explanatory documents for real estate agents (common throughout Japan). If you are buying a property outside of Tokyo, the outline is the same as below, but the details of the reduction measures may differ, so please contact the prefecture where the property is located for details. Three concrete examples of calculations are given at the end of this document, which we hope will help you to understand.

Real estate acquisition tax is levied on the acquisition of real estate (land or houses) by the prefecture in which the real estate is located, on the acquirer of the real estate (whether an individual or a company).

This tax is levied whether the acquisition is for value or free of charge, and whether the acquisition is registered or not. However, it is not levied in certain cases, such as when the property is acquired by inheritance. (Inheritance tax is levied on real estate that is inherited.)

As a general rule, the price of real estate as the tax base is based on its registered value in the fixed asset taxation register (assessed value of fixed assets).

The “price (tax base) of real estate” used in the calculation of the real estate acquisition tax is the price (assessed value) assessed and determined according to the fixed asset assessment standards set by the Minister of Internal Affairs and Communications, and in principle, the price registered in the fixed asset taxation register. Therefore, it is not the actual purchase price or building construction cost.

In the case of the acquisition of residential land, the price of the land shall be multiplied by 1/2 (this is a special measure until 31 March 2024).

Rice fields, fields, forests, and miscellaneous lands in areas where residential land development is possible are valued according to the residential land ratio method, in which the amount equivalent to the cost of construction necessary to make the land into residential land is deducted from the value of the land as if it were residential land. When such land is acquired, the treatment of real estate acquisition tax is the same as for residential land.

The tax rate for real estate acquisition tax is, in principle, 4% of the standard taxable value of land and buildings. Currently, the tax rate for land is 3% (until 31 March 2024). For houses, the rate is 3% (until 31 March 2024). However, the rate is 4% for non-residential buildings.

There is a reduction in the real estate acquisition tax if certain conditions are met. Here is a list of the most common ones. If the building is newly constructed and is a residential house (including self-residence, second house and rental house) and the floor area is between 50m2 (40m2 for rental houses other than detached houses) and 240m2, 12 million yen will be deducted from the assessed value of the fixed asset tax. You need to check with a tax accountant or other specialist to see if you are actually eligible for the reduction.

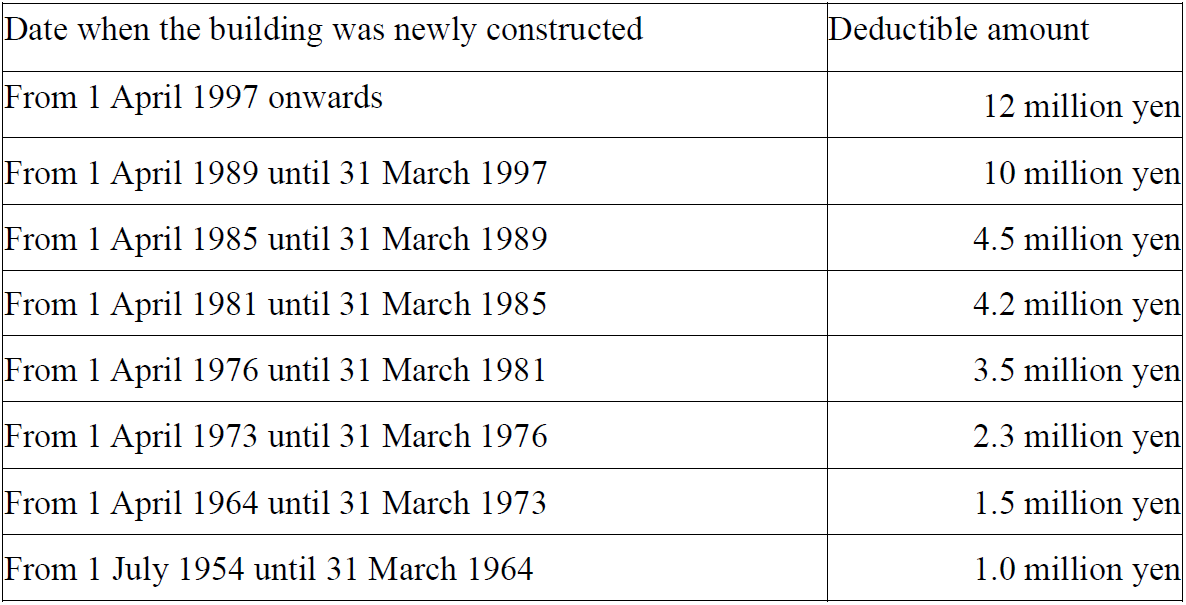

In addition, a deduction of between 1 and 12 million yen from the assessed value of the property tax is available for a second-hand building that complies with the new earthquake resistance standards, that is a house acquired by an individual for his or her own residence (rental flats are not eligible) and that has a floor area of between 50m2 and 240m2, and that meets the following conditions. The amount of deduction depends on the date when the property was built.

The table above gives an example for a property located in metropolitan Tokyo.

Conditions under which the deduction applies: The building was constructed on or after January 1, 1982. Or, the building is certified as conforming to the new seismic resistance standard.

We have written an explanation of the new earthquake resistance standards here.

If the property is a second-hand property that does not conform to the new earthquake resistance standard, and the individual acquires it for his or her own residence (rental flats are not eligible), and the floor area is between 50m2 and 240m2, and if the following three conditions are met within six months of acquisition (1) the property must be retrofitted for earthquake-resistance, (2) the property must be checked for compliance with the earthquake resistance standard after the retrofitting, and the property must be certified as compliant, (3)the acquirer must live in the refurbished house within six months of acquisition. The deduction ranges from 30,000 to 126,000 yen from the assessed value of the property. The amount of deduction depends on the date when the property was built.

For example, according to the home page of the Tokyo Metropolitan Government’s Bureau of Taxation, the conditions for this application include the following points. If you have already completed the seismic retrofitting work before you acquired the property, you cannot apply. If you live in the property before the requirements of (2) are fulfilled, it is not applicable. These points may be operated differently by each prefecture.

If you acquire land for a house, and only if the building is eligible for the above-mentioned reduction measures, the real estate acquisition tax is also reduced for the land.

If certain conditions are met, the higher of (a) or (b) below will be reduced from the tax on the land.

(a) 45,000 yen

(b) [Price per square metre of land] times [Twice the floor area of the house(up to a maximum of 200 sqm per dwelling) ]times[Equity in the acquisition of a house]times 3%

In order to qualify for the special tax exemption, it is necessary to file a declaration in accordance with the regulations of the prefecture that has jurisdiction over the location of the property concerned.

Here is a concrete example of the calculation of real estate acquisition tax.

How do I calculate the reduction in real estate acquisition tax when I acquire a house for sale with land?

Question No.1

I purchased a new house with land (residential land) on 19 May 2021.

The area of the land is 125 m2 and the house has a total floor area of 150 m2.

The assessed value of the land is 72 million yen and the assessed value of the house is 12.6 million yen.

What is the amount of tax to be paid?

Answer No.1

The tax amounts are as follows:

For the house: Real estate acquisition tax is reduced.

■Tax base amount

Price 12,600,000 yen – Deduction 12,000,000 yen = 600,000 yen (tax base amount)

■Tax amount

Tax base amount 600,000 yen × 3% = 18,000 yen (tax on houses)

For the land

As this is an acquisition of residential land, the price is multiplied by 1/2.

In addition, a new house on land acquired at the same time will qualify for the reduction as it meets the prescribed requirements.

■Tax base amount

Price 72 million yen × 1/2 = 36 million yen (tax base amount)

■The amount of tax to be calculated once provisionally

Tax base amount 36 million yen × 3% = 1.08 million yen (the amount of tax to be calculated once provisionally)

■The amount of the reduction

45,000 or the amount calculated as follows, whichever is the greater

Price per sqm of land (36 million yen / 125 sqm) = 288,000 yen

Double the floor area of the house (200m2 limit) = 150m2 x 2 ≥ 200m2

(Price per square metre of land) x (twice the floor area of the house) x 3% = 1,728,000 yen(The amount of the reduction)

Here, 1,728,000 yen > 45,000 yen

■Tax amount

Tax amount to be calculated once provisionally 1,080,000 yen – reduced amount 1,728,000 yen ≤ 0 yen (tax on land)

Question No.2

How much will the real estate acquisition tax be if I acquire an existing condominium that is not for my own use?

Suppose the assessed value of the land for property tax purposes is 30 million yen and the assessed value of the building for property tax purposes is 10 million yen. If the property does not meet the conditions for receiving a reduction for a second-hand home;

Answer No.2

Real estate acquisition tax for buildings 10 million yen x 3% = 300,000 yen

Real estate acquisition tax for land 30 million yen × 1/2 × 3% = 450,000 yen

The total real estate acquisition tax will be 750,000 yen.

Question No.3

How much will the real estate acquisition tax be if I acquire an existing condominium for my own use in 2021 (built in 2009, taxable floor area 70m2, co-ownership land area 50m2, located in Tokyo)? We assume that the assessed value of the land is 30 million yen and the assessed value of the building is 10 million yen.

Answer No.3

Real estate acquisition tax for buildings (10 million yen – 12 million yen) × 3% = 0 yen

Calculation of real estate acquisition tax credit for land

A = 45,000 yen

B = (30,000,000 yen / 50m2) x 1/2 x 140m2* x 3% = 1,260,000 yen

*70m2 x 2 = 140m2

140㎡ < 200㎡ therefore 140㎡

Since it is the greater of A or B, the deduction for land is 1,260,000 yen.

Real estate acquisition tax for land (30 million yen × 1/2 × 3%) – 1,260,000 yen = 0 yen