What is the registration tax?

Registration tax is levied when a person acquires real estate (land or a house) and registers his or her ownership, or when the contents of the register are changed. Registration tax is a “national tax” levied by the Japanese government.

The registration tax is calculated by multiplying the registered value (assessed value of the property) in the property tax register by a certain tax rate.

Tax amount = tax base multiplied by tax rate

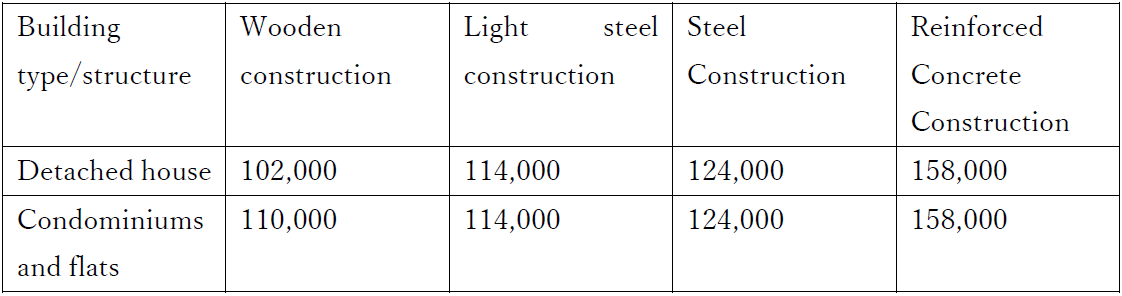

If you have just built a new house and it does not have a fixed asset tax assessment value, the taxable value will be the value certified by the registrar based on the “Table of Standards for Certifying the Taxable Value of Newly Constructed Buildings” at the Legal Affairs Bureau. For your reference, the following is an excerpt from the list of standards for certifying the taxable value of new buildings in the jurisdiction of the Tokyo Legal Affairs Bureau in 2021.

The figures in the table above show the unit price (in yen) per square metre.

For information on tax rates, please see below.

For the registration of new house*

For the registration of second-hand house**

Please refer to the column marked with an asterisk (*).

■Registration of transfer of ownership of land ***

(1) Registration of transfer of ownership of land In the case of transfer by sale: 20/1,000 as a general rule, but 15/1,000 in the case of registration before March 31, 2023.

In the case of transfer by inheritance: 4/1,000 in principle.

■Reduction of registration tax for buildings used for residential purposes

Registration tax for the registration of preservation or transfer of ownership of a house newly built or acquired for use as a residence (in this case, you, the acquirer, must personally reside in the house), or for the registration of mortgage in the case of receiving a loan for the acquisition of the house, will be reduced as follows until March 31, 2022.

| Type of registration |

Principle tax rate |

Eligible Houses |

| Registration of the preservation of ownership *Refer to (2) | 0.4% ↓ 0.15% (Note 1) |

Houses with a floor area of 50 square metres or more used for private residential purposes. |

| Registration of transfer of ownership ***Refer to (3)(a)(b)(c) |

2.0% |

・A house with a floor area of 50 square metres or more used as a private residence. ・In the case of a second-hand house, the house must be less than 25 years old (less than 20 years old for wooden houses) or meet certain earthquake resistance standards. |

| Registration of the mortgage ***Refer to (4)(a)(b)(c) | 0.4% ↓ 0.1% |

Same as above column |

(Note 1) *The tax rate of registration tax for new construction of long-term excellent housing and certified low-carbon housing is reduced to 0.1% (0.2% for transfer registration of detached long-term excellent housing) as a measure until March 31, 2022.

(Note 2) **The tax rate of registration tax for the acquisition of a purchased resale house bought by real estate companies, renovated and resold is reduced to 0.1% as a measure until March 31, 2022.

(2) *Registration of preservation of the ownership of a building (this term refers to the registration of an unregistered building): 4/1000 in principle.

In the case of registration of preservation of ownership of a building, where an individual has newly built a residential house or acquired a residential house which has never been used after its construction until March 31, 2022, and has used it for his/her own residence, the rate is 1.5/1000. When applying for registration, a certificate from the municipality where the house is located must be attached. Please note that even if you submit the certificate after the registration, the reduced tax rate will not be applied.

Requirements for the new home reduction exception (a) You, the acquirer, must live in the house yourself (b) The house must have been registered within one year after the construction of a new custom-built house or the acquisition of a condominium or detached house (c) The registered floor area must be 50m2 or more.

(3) *** Registration of transfer of ownership by sale or auction of a building In principle, 20/1000.

However, if the following conditions are met, there is a reduction measure.

(a) *** In the case where an individual acquires a residential house (limited to sale and auction) and uses it for his/her own residence before March 31, 2022, the registration of transfer shall be made at the rate of 3/1000.

(b) *If an individual newly builds a residential house or acquires an unused residential house after construction and uses it for his/her own residence before 31 March 2022, and the residential house is classified as a “Specified Certified Excellent Long-term Housing” as defined separately, the tax rate is 1/1000 for the preservation or transfer registration. (In the case of the registration of the transfer of a “Specified Certified Excellent Long-term Housing” of a detached house, the rate is 2/1,000.)

(c) *If an individual newly builds a residential house or acquires an unused residential house before 31 March 2022 and uses it for his/her own residence, and the residential house is a ” Certified Low Carbon Building” as defined separately, the tax rate is 1/1000 for the preservation or transfer registration.

(4) Mortgage registration of housing mortgages.

In principle, 0.4% of the amount of the claim. However, in the case of mortgages that meet certain requirements(refer to(3)(a)(b)(c)), the tax rate may be reduced to 0.1%.

(Note 3) **Requirements for second-hand home reduction (1) You, the acquirer, must personally reside in the home (2) The condominium or detached house must have been registered within one year of acquisition (3) The registered floor area must be 50m2 or more (4) Fireproof buildings such as condominiums must be no older than 25 years, and buildings other than fireproof buildings such as wooden buildings must be no older than 20 years.

**For houses that have exceeded the above useful life, the reduced tax rate can be applied only if it can be proved that the house complies with the New Earthquake Resistance Standards by using “documents proving the earthquake resistance standards” (either a certificate of conformity to the earthquake resistance standards, or a housing performance evaluation certificate with an earthquake resistance rating of 1, 2, or 3, or a certificate of insurance for existing house sales defect insurance if the house is insured).

■Registration of transfer of ownership of land and a building by inheritance or gift of a house

As a general rule, for both buildings and land

In the case of inheritance: 4/1000 of the assessed value of the property tax

In the case of a gift: 20/1000 of the assessed value of the property tax